The Role of Consumer Behavior in Insurance Marketing

Insurance companies sure do know how to make a cute and engaging ad, don’t they? There’s the chaos agent of one company, the discount “verifier” of another, and the cute talking animals of yet another. Insurance companies take a lot of chances to gain our attention and business. And they have to, given all the online “noise” of content out there.

People increasingly rely on online research and digital tools to discover and assess their insurance options. Memorable advertising ensures people remember an insurance brand name while the ads themselves highlight insurance product features that align with customer needs. Smart insurance marketing helps shape the perceptions of the insurer and guide consumers’ decision-making processes.

How else does consumer behavior shape marketing for insurance brands?

Understanding Consumer Behavior in the Insurance Sector

Consumer behavior plays an important role in how we decide what to buy. People have to navigate across emotional factors, cognitive biases, and life uncertainties to identify risks, evaluate coverage options, and finally, decide to buy. Here are a few of the elements that influence consumer behavior for insurance purchases.

Psychological factors: Emotions, beliefs, and personal experiences are a big influence on consumers’ perceptions of risk and their subsequent insurance choices. For example, new parents may choose life insurance because of their love of their family. Fear of future illness and financial instability may push others towards comprehensive health coverage.

Social factors: Social proof, recommendations, and family opinions are influential today. Consumers who see social proof online often feel more assured about insurance options and providers than those without it.

Economic factors: Income levels, financial stability, and job opportunities are another influence on insurance choices. Consumers with restricted budgets may prioritize affordability over comprehensive coverage, whereas higher-income consumers may prioritize premium options to mitigate perceived risks more fully.

Digital factors: The rise of digital platforms has transformed the way consumers interact with brands and shop online. Today’s consumers increasingly rely on these digital tools and online research to assess large purchases like insurance. Bain & Company found that digital channels are best for simple interactions like bill payments. They prefer a human/digital combination for complex ones like filing a complex claim or getting advice.

Importance of Consumer Insights for Insurance Marketing

Since advertising and marketing can significantly influence consumer behavior, insurers must use every tool to craft engaging messaging in the right channels to reach their primary markets. Demographics like age, gender, income, and education level are another layer of information they can add to the mix to discover more complete insights about their consumers and primary audiences.

It starts by highlighting product features aligned with consumer needs and concerns. For example, a couple starting a family has different needs than a single adult living in an urban center. Tailoring marketing ensures that the messaging resonates with potential consumers, increasing the likelihood of policy purchases.

While having a cute mascot or theme in insurance advertising can make the brand more memorable, it won’t sell if it’s not paired with an adequate explanation of product features. People may respond to emotionally charged elements and rely on their ingrained cognitive shortcuts when researching. But when it comes time to buy, they still want rational information like coverage limits and claim process outlines to assess the factors that align with their life stage.

Combining product features with positive decision framing is a good way to balance those two things. For example, aligning health insurance coverage options with a healthy living reward program. Framing insurance as part of healthy living is a good strategy today. Nearly 60% of consumers want life insurers to reward them for healthy living somehow, according to a Bain & Company survey.

Segmenting a customer base and audience can help insurers reach specific groups of people at a time. Data analytics can identify potential customers early on, helping them create personalized marketing and product bundles that resonate with them quickly, helping them stay ahead of evolving consumer needs.

Using Consumer Insights for Insurance Marketing

Grouping consumers by shared characteristics and needs helps simplify and focus marketing for insurance companies. They can tailor products, services, and marketing efforts to better meet the specific needs of each segment. That leads to more effective marketing, increased customer loyalty, and improved sales.

For insurance companies, that means looking at data like age, gender, income range, location, and housing situation. EASI customers can use our databases, reports, and 40,000+ variables to find this information and dive deeper into it to focus on unique segments. For example, when looking at location data, Block Groups and ZIP Code data can identify whether many residents have cars and mortgages. Urban areas with higher densification may have lower car ownership rates than suburban ones.

Further, combining EASI’s databases with internal customer information can help insurers develop a highly detailed and accurate picture of their segments and consumers. That means integrating CRMs, email newsletter apps (like Kit and Aweber,) and ad platforms (like Google or Microsoft Ads) to create a comprehensive 360-degree view of people. Then, they can use those same integrations to personalize insurance marketing campaigns and deliver the right message to the right people at the right time.

Challenges and Ethical Considerations of Consumer Insights in Insurance Marketing

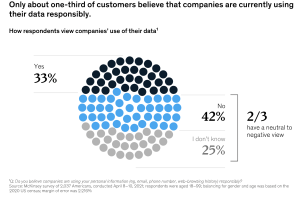

As marketing personalization becomes more sophisticated, so do privacy and data security concerns. According to McKinsey, nearly half of respondents have a negative view of brands’ use of their data. (Graphic source: McKinsey)

Consumers want that seamless, personalized experience, but they also want assurance that brands collect only necessary data and store it securely. They want relevant marketing and advertising but don’t want to feel “watched.” Balancing the two is challenging, especially for insurance companies who need more personal data than other consumer brands to develop the right products and market them to people.

Insurance companies who want to increase their privacy game while still maintaining a high personalization level for their audiences should:

- Shift to first-party or zero-party data by collecting data directly from users through online forms and questionnaires

- Offer transparent data policies and value exchanges by clearly stating how consumer data is used and what’s offered in return for the exchange of data

- Obtain clear and informed consent, especially at the point of data collection

- Only collect the data needed for specific marketing purposes (data minimization)

- Offer alternative communication channels for consumers who prefer not to share data

- Use privacy-enhancing technologies and approaches to protect data through enhanced cybersecurity training for staff, keeping data stores well-protected, and updating all technologies that touch consumer data

Consumer behavior matters to insurers

Understanding consumer behavior in insurance is essential for insurers. That means understanding the various psychological, social, and economic factors that shape consumer buying decisions. Taking consumer behavior into account allows insurance companies to tailor their products and services more effectively while helping consumers make informed choices for their situations.

To discover the consumer insights that will help your insurance company stay ahead of the competition, reach out to EASI today.

Share on Facebook Share on Twitter Share on Pinterest